WE LIVE AND BREATHE EVERYTHING VAT

We don’t rest until you get what is rightfully yours – Maximum foreign VAT refund

We don’t rest until you get what is rightfully yours – Maximum foreign VAT refund

With start up in Sweden, Cash Back was the 1st company 30 years ago to assist businesses recover their foreign VAT on cross-border activities, making the most of the laws and regulations in place throughout Europe.

Today, we have grown into an extensive network of experienced indirect tax experts with a deep insight into the continually changing VAT legislation, which impacts companies doing business abroad.

One of the most common expenses eligible for VAT refund is your employees’ business travel costs incurred throughout Europe, Australia, New Zealand, South Korea and Taiwan.

Subject to the different rules, regulations and VAT rates applicable in each country, a company can recover the VAT on these travel expenses including hotel nights, restaurants, car rental, fuel, rail and other public transport costs.

Moreover, we have years of experience managing the recovery of VAT on the unique services specifically related to your industry, whether it be the pharmaceutical, automotive, leisure or another industrial sector.

With over € 1 Billion recovered in VAT for companies, our experts have in-depth knowledge in all the various VAT recovery schemes and how to maximise your refunds.

30

Years of Commitment for Your Savings

One of the

LARGEST

ON-GROUND

NETWORKS

We have one of the most extensive networks with on-the-ground local experts ready to support you at any time. We are physically present in all countries where you have claimable VAT expenses and our winning process is implemented across all locations to ensure consistency and a successful outcome every single time.

With Cash Back and our team of experts you recover maximum VAT back in the fastest time.

EUROPE:

REST OF THE WORLD:

To comply and maximise your VAT refunds in today’s digital world, it is essential to still have local VAT experts who know the regulations and nuances of VAT registration, filings and refund requirements in 40+ countries and not only leave it to technology.

Our indirect tax experts in each country know the local regulations and speak the local language to readily converse with the local tax authorities to efficiently manage your claims.

Given that the complexities, rules and regulations vary from country to country; companies often miss opportunities to claim 100% of their eligible VAT. According to a study in 2016, more than €19 billion is left unclaimed in available VAT refunds.

With our legacy, experience, global network and processes we have maximised refunds for companies like yours with up to 40% more.

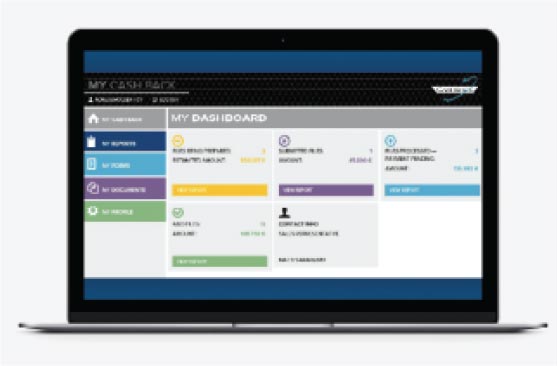

Every client of Cash Back gets access to a portal that gives complete transparency into every step of the VAT recovery process. From invoice collection to VAT refunds transferred to your bank, you have full visibility of each move in the process.

Full visibility of the processing times, the date and amount of refunds as well as your applications in each respective country provides accountability and gives you peace of mind.

We go a step further to ensure there is no delay in your refunds. Through our integrated payment system with our bank and our Client Trust Accounts, your VAT is swiftly and securely transferred directly to your account.